RED OAK ISD BOND ELECTION SEEKS ONE PROP APPROVAL

RED OAK – The Nov. 8 election ballot will have the Red Oak community voting once again on a Red Oak ISD bond.

The Red Oak ISD Board unanimously approved calling for the Nov. 8 Bond Election for just one item – a new, second middle school with a 1,200 student capacity. The bond amount is $94,000,000, which includes the constructing, acquiring, and equipping a new (second) Middle School.

Beth Trimble, Red Oak ISD, Executive Director of Communications said, “The three major differences between the May and November bond elections for Red Oak ISD are the requested changes by the community.”

First, ROISD narrowed the bond election to a single proposition based on the greatest need – a second ROISD middle school. This will alleviate overcrowding and address projected future growth for grades 6-8 for well over the next decade.

Second, the community asked to see what they would be voting on – preliminary designs on land already owned by the district. The designs can be seen at www.roisdbond.com and were presented at two community meetings and the Board Meeting.

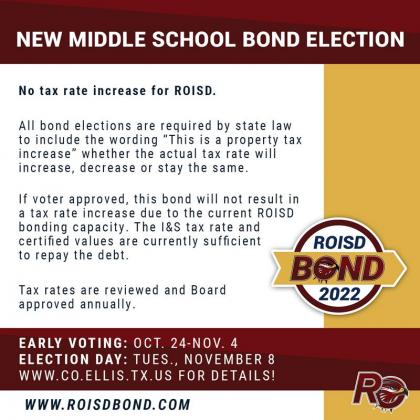

Finally, no I&S tax rate increase. The District’s AAA rating and bond capacity are such that the current tax rate will cover the debt payment if the bond passes.

“The biggest obstacle is education,” Trimble said. “By state law, the order must say ‘this is a property tax increase’ because it will be paid off by property taxes. However, it is not a rate increase. The state method for public school districts to build new facilities is through the selling of bonds and repayment from local taxpayers by way of debt service funds. Public ISDs are even penalized by the state if they try to save funds to build facilities.”

ROISD’s current middle school is said to be well over capacity – added portables will be fully operational very soon. Trimble said a second middle school would provide opportunities for more students to be involved in campus activities, increasing attendance and academics, and reducing discipline matters.

“Red Oak ISD has been both fiscally responsible and transparent,” Trimble concluded. “The district has repaid previous bonds early saving thousands in taxpayer dollars. They have done so while reducing the tax rate each of the last four years – with the lowest rate of the big four Ellis County ISDs and the lowest debt owed of area large districts.”

Early voting will be at the Red Oak Municipal Center and Cowboy Church of Ellis County beginning Oct. 24 to Nov. 4, 2022. Election Day is Nov. 8 from 7 a.m. to 7 p.m. at Red Oak Municipal Center and Eastridge Baptist Church.

NO TAX INCREASE FOR 65 AND OLDER – Under state law, the dollar amount of school taxes imposed on the residence homestread of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65 or disabled, regardless of changes in tax rate or property value, unless there are new improvements to the homestead that increase the value of the home. You must apply for this exemption.